The Government have confirmed a £12bn rise in National Insurance from April 2202. Employees, employers and the self-employed will all pay 1.25p more per pound in National Insurance (NI).

These changes announced at last year’s Budget, are expected to raise £12bn a year, which will go initially towards easing pressure on the NHS. A proportion will then be moved into social care system over the next three years, being rebranded as a Health and Social Care Levy from 2023.

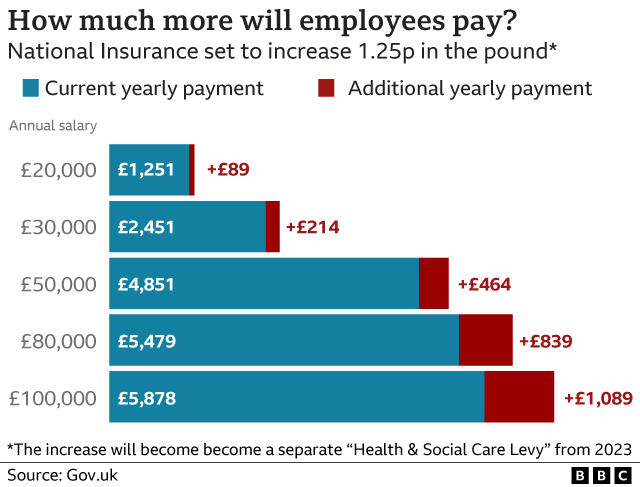

How much more tax will employees pay?

The changes to National Insurance will see an employee on £20,000 a year pay an extra £89 in tax. Someone on £50,000 will pay £464 more. From April, people earning under £9,880 a year, or £823 a month, will not have to pay National Insurance and will not have to pay the new levy.

Along with a rise in cost of living, including sky-high gas and energy tariffs, critics have said the increase will have a higher impact on the lower-paid.

Source: BBC News

How will the rise affect businesses?

As ever, these changes will have an impact on small and medium size business across the UK. Employers will also have to pay more, contributing 15.05% in National Insurance on employees’ earnings over £170 per week, up from 13.8% now.

The employer’s allowance, which for many businesses will cover the first £4,000 of some company National Insurance costs, is still available. This will then be extended to cover the new Health and Social Care Levy when that becomes a separate item.

Here to help your business

From payroll support to tax planning and advice, as Chartered Certified Accounts, TBL Accountants are here to support you.

You can contact the team by completing an enquiry form here, or call our Southend office.