On 3 March 2021, the Chancellor of the Exchequer, Rishi Sunak, delivered one of the most closely watched Budget updates in a generation.

In his Budget speech, Mr Sunak set out the government’s tax and spending plans for the year ahead, outlined new measures to help business and jobs through the coronavirus pandemic and to support the UK’s long-term economic recovery and a series of tax-raising plans to help rebalance the public finances.

Here is what was announced in the UK Budget 2021:

The Budget at a glance

Coronavirus response

An extension to the Chancellor’s flagship furlough scheme and more coronavirus support dominated the Budget 2021.

Furlough to be extended until the end of September 2021

- Government to continue paying 80% of employees’ wages for hours they cannot work

- Employers to be asked to contribute 10% in July and 20% in August and September

Support for the self-employed also to be extended until September

- 600,000 more self-employed people will be eligible for help as access to grants is widened

£20 weekly uplift in Universal Credit worth £1,000 a year to be extended for another six months

Working Tax Credit claimants will get £500 one-off payment

Minimum wage to increase to £8.91 an hour from April

An extra £1.65 billion cash injection to ensure the Covid-19 vaccination roll-out in England continues to be a success.

£100 million for a new Taxpayer Protection Taskforce to crack-down on COVID fraudsters who have exploited UK Government support schemes.

Economy update

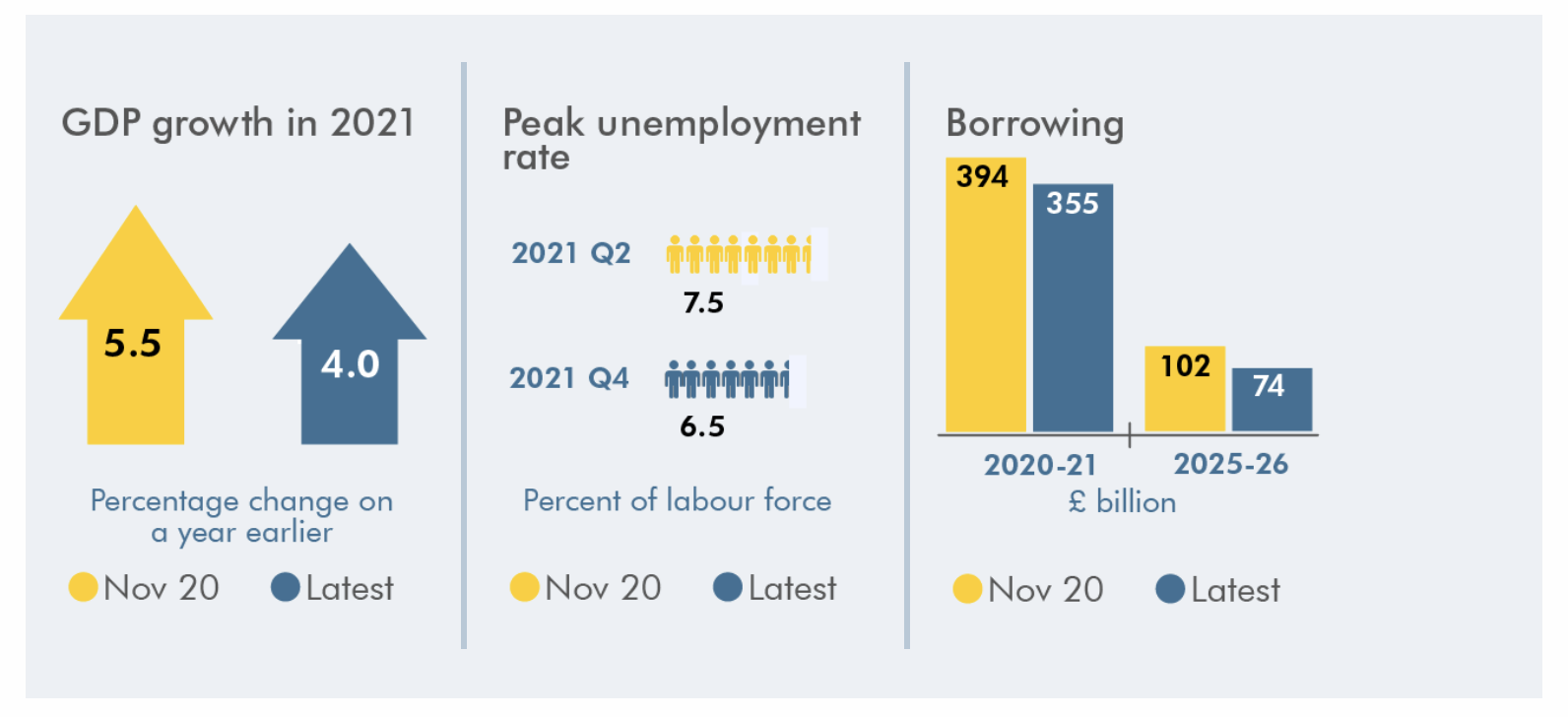

The Office for Budget Responsibility (OBR) predicted GDP to grow by 4 per cent in 2021 and to regain its pre-pandemic level in the second quarter of 2022. However, unemployment still rises by a further 500,000 to a peak of 6.5 per cent at the end of 2021, but the peak is around 340,000 less than the 7.5 per cent assumed in our November forecast, thanks partly to the latest extension of the furlough scheme.

UK economy shrank by 10% in 2020

- Economy forecast to rebound in 2021, with predicted annual growth of 4% this year

- Economy forecast to return to pre-Covid levels by middle of 2022, with growth of 7.3% next year

700,000 people have lost their jobs since pandemic began

- Unemployment expected to peak at 6.5% next year, lower than 11.9% previously predicted

UK to borrow a peacetime record of £355bn this year.

- Borrowing to total £234bn in 2021-22

Source: Office for Budget Responsibility (OBR)

Taxation

No changes to rates of income tax, national insurance or VAT

- Tax-free personal allowance to be frozen at £12,570 from April 2021 levels to 2026

- Higher rate income tax threshold to be frozen at £50,270 from April 2021 levels to 2026

Corporation tax on company profits above £250,000 to rise from 19% to 25% in April 2023

- Rate to be kept at 19% for about 1.5 million smaller companies with profits of less than £50,000

Stamp duty holiday on house purchases in England and Northern Ireland extended to 30 June

- No tax charged on sales of less than £500,000

Inheritance tax thresholds, pensions life time allowances and annual capital gains tax exemptions to be frozen at 2020-2021 levels until 2025-26

- For the first time since 2004, no changes have been made to private pensions taxation

Health and Education

£1.65bn to support the UK’s vaccination rollout and £50m to boost the UK’s vaccine testing capability

£19m for domestic violence programmes, funding network of respite rooms for homeless women

£40m of new funding for victims of 1960s Thalidomide scandal and lifetime support guarantee

£10m to support armed forces veterans with mental health needs

The Arts and Sport

Nearly £400m to help arts venues in England, including museums and galleries, re-open

£300m recovery package for professional sport and £25m for grassroots football

£1.2m to help stage delayed Women’s Euros football tournament in England in 2022

Extension of the Film & TV Production Restart scheme in the UK, with an additional £300 million to support theatres, museums and other cultural organisations in England through the Culture Recovery Fund.

Business

Tax breaks for firms to “unlock” £20bn worth of business investment

- Firms will be able “deduct” investment costs from tax bills, reducing taxable profits by 130%

£7 million for a new “flexi-job” apprenticeship programme in England, that will enable apprentices to work with a number of employers in one sector.

Additional £126 million for 40,000 more traineeships in England, funding high quality work placements and training for 16-24 year olds in 2021/22 academic year.

Lower VAT rate for hospitality firms to be maintained at 5% rate until September

- Interim 12.5% rate will then apply for the following six months

Business rates holiday for firms in England to continue until June with 75% discount after that

£5bn in Restart grants for shops and other businesses in England forced to close

- £6,000 per premises for non-essential outlets due to re-open in April and £18,000 for gyms, personal care providers and other hospitality and leisure businesses

Small and medium-sized employers in the UK will continue to be able to reclaim up to two weeks of eligible Statutory Sick Pay (SSP) costs per employee from the Government.

New visa scheme to help start-ups and rapidly growing tech firms source talent from overseas

Contactless payment limit will rise to £100 later this year

Fuel and alcohol duties

All alcohol duties to be frozen for second year running

- No extra tax on spirits, wine, cider or beer

Fuel duty to be frozen for eleventh consecutive year

Tobacco duties to rise by inflation plus 2%

The environment and infrastructure

New UK Infrastructure Bank to be set up in Leeds

- It will have £12bn in capital, with aim of funding £40bn worth of public and private projects

£15bn in green bonds, including for retail investors, to help finance the transition to net zero by 2050

Nations and regions

£1.2bn in funding for the Scottish government, £740m for the Welsh government and £410m for the Northern Ireland executive

750 UK civil servants to be relocated to new Treasury campus in Darlington

£1bn fund to promote regeneration in a further 45 English towns, including Middlesbrough, Preston, Swindon, Bournemouth, Newark, West Bromwich and Ipswich

£150m for community groups to take over pubs at risk of closure

First eight sites announced for freeports in England: East Midlands Airport, Felixstowe and Harwich, Humber, Liverpool City Region, Plymouth, Solent, Thames and Teesside

2021 Budget in brief

Delivering the budget in Parliament Chancellor of the Exchequer Rishi Sunak said:

‘This Budget meets the moment with a three-part plan to protect the jobs and livelihoods of the British people.

First, we will continue doing whatever it takes to support the British people and businesses through this moment of crisis.

Second, once we are on the way to recovery, we will need to begin fixing the public finances – and I want to be honest today about our plans to do that.

And, third, in today’s Budget we begin the work of building our future.’

View official Budget documents

Learn more in the ACCA Guide to The Budget here.

TBL Accountants are your local accountancy firm operating in Southend and across Essex. We specialise in a variety of services as personal, business, and charity accountants. Want to find out more? Get in touch with our team today.

Here for you.