Executive Summary

The responses to this survey confirm the widely held view that SMEs have been dramatically impacted by the effect of the pandemic. A total of 1,793 respondents, 42% report that they have closed their business as a result of the lockdown. A full 88% of respondents have had to scale down operations or close.

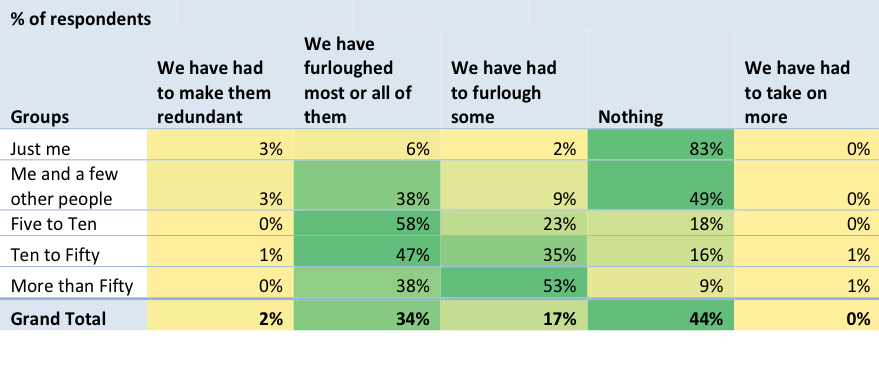

52% of respondents have furloughed some or all of their employees. Only the smallest businesses have had to make their staff redundant, with 2% of respondents having done so. Recruitment is frozen across the board. There is stratification between businesses of different sizes here; the larger businesses are making much more use of the furlough scheme than the smaller businesses (comparing businesses of 5-50+ people to those of 2-5 people).

The outlook shared by respondents in bleak. If the lockdown extends to 30 June, 73% of respondents expect to scale down or close (17% expect to close permanently). Again, we see that bigger businesses expect to be more resilient; 1 in 5 of those with fewer than 10 people expect to close permanently. If the lockdown goes beyond 30 June, a full 31% expect to close permanently, while bigger businesses again appear to feel most resilient as a smaller (but significant) 24% of businesses of >10 people expect to close permanently.

Despite this outlook, 71% of respondents have not approached the banks for support. Why? We can only speculate in terms of this survey. Is there no confidence in future performance to take on debt? Of the businesses who have approached the banks, 66% have had problems or have been refused funding. Bigger businesses see a greater proportion approaching the banks, with 56% of >50 people businesses having done so (vs 29% overall). There is a different experience felt by different business sizes; of applicants to the banks, 71% of applicants of 2-10 people have experienced difficulty, vs a smaller 44% of >50 people applicants.

The respondents are almost united in the impact they have felt from the lockdown, and their pessimistic outlook for the coming months and beyond. The furlough scheme has certainly been accessed, while bank support is interestingly much less accessed. We see different experiences of business sizes throughout the responses.

Overview of dataset

A total of 1,793 respondents submitted the survey.

Of these, 68% (1,214) classified themselves as limited companies. Sole traders accounted for 19%, Partnerships 10%, and the remainder “Other”. The responses are most representative of limited companies.

60% (1,073) of respondents are businesses with fewer than 5 people. By business type, 91% of sole traders reported fewer than 5 people, while 52% of companies report fewer than 5. Of companies, 41% (494) have between 5 and 50 people, with 7% (88) reporting >50 people. All business sizes are reasonably represented.

92% (1,758) of respondents are based in England, which follows for each entity type. 35% of all respondents are from London and the South East, with a further 28% from the north of England. Wales returned 111 respondents, Northern Ireland 15, Scotland 10.

Business performance

92% (1,648) of respondents reported that business was as expected or better prior to lockdown. Within the regions this is born out.

40% (724) report this time of year as busy as the rest of the year, with a further 53% (957) reporting it as their very busy period. This is reflected across all business types and regions.

Lockdown impact

A full 42% (746) of respondents have closed their business as a result. [22% due to government instruction, 20% due to business falling to nothing]. 38% of limited companies (467) report closure, vs 53% of sole traders (178).

47% (833) of respondents are running but with reduced trade volumes, therefore a full 88% of respondents have been negatively impacted by the lockdown (12% carry on as normal or better).

There is a stratification between business sizes. Larger entities (>50 people) have fared better but still we see 29% (33) of this group reporting that they have closed. A larger 20% of this group (22) report business being the same or better (vs 12% of the full dataset).

Regionally, London and SE fares best with 36% (229) reporting closure vs the population’s 42%. Overall, negatively impacted businesses in London and the SE is the same as the population, at 88%.

Wales appears to be the worst hit region, with 52% (58) reporting closure. Scotland reports the same, but the sample size is too small to be reported.

Employees

52% of respondents (924) have furloughed some or all of their employees. This rises to 60% (734) of limited companies. Only 2% of businesses (33) have made their staff redundant, and these have been the smallest businesses (31 of them fewer than 5 people). Does this indicate the furlough scheme is being used for its intended purpose?

6 businesses in total report having taken on more staff. Recruitment is frozen.

Across business sizes, there is stratification. Of the smallest (2-5 people), 48% (292) have furloughed some or all, but of businesses with 5-50 people, 82% (207) have furloughed some or all employees.

In the >50 people group, this rises to 90% (101). The biggest businesses are the ones most likely to have made use of the furlough scheme.

Table 1 – What have you done about your staff? [By number of people]

Continued lockdown to 30 June

If the lockdown continues to 30 June, 17% (312) of businesses expect to close permanently, a further 19% expect to close temporarily (346), and 36% (649) expect not to close but to scale down their operations further. In total therefore, 73% expect to scale down or close (1,307).

For all businesses with >10 people, a lower proportion of 12% (55) expect to close permanently but a larger 50% (232) expect not to close but to scale down operations.

For respondents with businesses of <10 people, 1 in 5 (257) expect to close permanently.

Continued lockdown beyond 30 June

The view becomes more pessimistic as 31% of all respondents (558) expect to close permanently. 82% in total expect to scale down or close (1,465).

For all businesses with >10 people, now 24% (110) expect to close permanently. More bigger businesses expect to ride out the storm without closure.

No regional findings to note in either of these cases.

Emerging from lockdown

58% (1,036) of respondents expect a slow start that is hard to predict, while a further 27% (488) agree that the restart will be slow, but that normality will return. Therefore 85% of respondents (1,524) expect slow beginnings. The largest businesses (>50 people) are more bullish where 40% (45) expect a slow start but a return to normality.

29% (522) are concerned their business will not survive the effect of the crisis, while a further 53% (950) expect to survive but “this year is a write off”.

This generally follows for business sizes, but those with >50 people feel most resilient. Only 13% (14) are concerned they won’t survive and 1 in 5 (22) in this group expect the year to turn out as normal, vs 16% for all our business sizes (264).

Support from the banks

Interestingly, despite the pessimistic outlook presented above, 71% of respondents (1,273) have not approached the banks for support. This raises further questions. Is this due to confidence in liquidity, despite the concerns for longevity presented? Is it an indicator that businesses are reluctant to take on debt with no confidence in future profitability (“this year is a write off”)? These can’t be answered here.

Of the remaining 28% [NB, rounding] who have approached the banks for funding, 1 in 5 (100) have found them to be very helpful and a further 14% (70) have received the funding they need. 66% (323) of those who have approached the banks, have had problems or have been refused funding.

Of businesses with 10-50 people, 41% (142) have approached the banks while 56% of the >50 people businesses (63) have done so. Bigger businesses appear to be more comfortable/savvy/have felt the need to approach the banks.

In the >50 people group of those who approach the banks, only 44% (28) of applicants have had trouble getting the funding they need. Conversely, of businesses of 2-10 people who have approached the banks, 71% (156) have experienced trouble.

As perhaps expected, the biggest businesses appear to be finding it the easiest to get access to lending.

About the survey and the data

The survey was undertaken by the UK200Group the UK’s leading membership association of independent, quality assured chartered accountancy and law firms. We are one of the member firms.

Responses were captured in the first 3 weeks of April 2020. 1,793 SME businesses from across the UK participated in the survey.

With particular thanks to Andrew Jackson of Fiander Tovell and Nick Forsyth of Lambert Chapman who created our initial survey; and to Reuben Barry of Ecovis Wingrave Yeats who conducted an independent analysis and is the author of this report.

TBL Accountants are your local accountancy firm operating in Southend and across Essex. We specialise in a variety of services as personal, business, and charity accountants. Want to find out more? Get in touch with our team today.

Here for you.